Case Studies

10% reduction in loan losses through smarter credit scoring models

Financial Services, Risk ManagementOur credit risk model used machine learning & regression variants to reduce losses by 10%

Approach

- Client was a large global bank

- Indus re-developed the application stage risk model for Client’s Personal Loans business, followed by credit policy redesign

- Indus tested various scorecards, horseraced multiple modeling techniques, validated on in & out of time samples, and developed final models

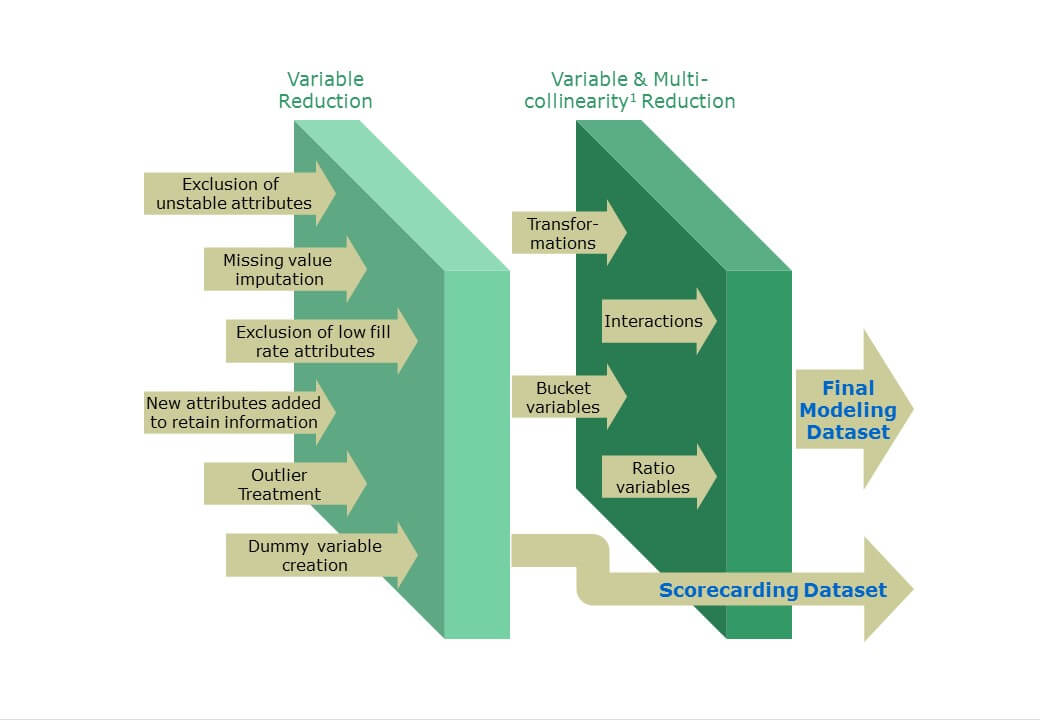

- 1000+ predictor variables were used for modeling; Reject Inferencing done to calibrate model on turndowns

Analysis

Results

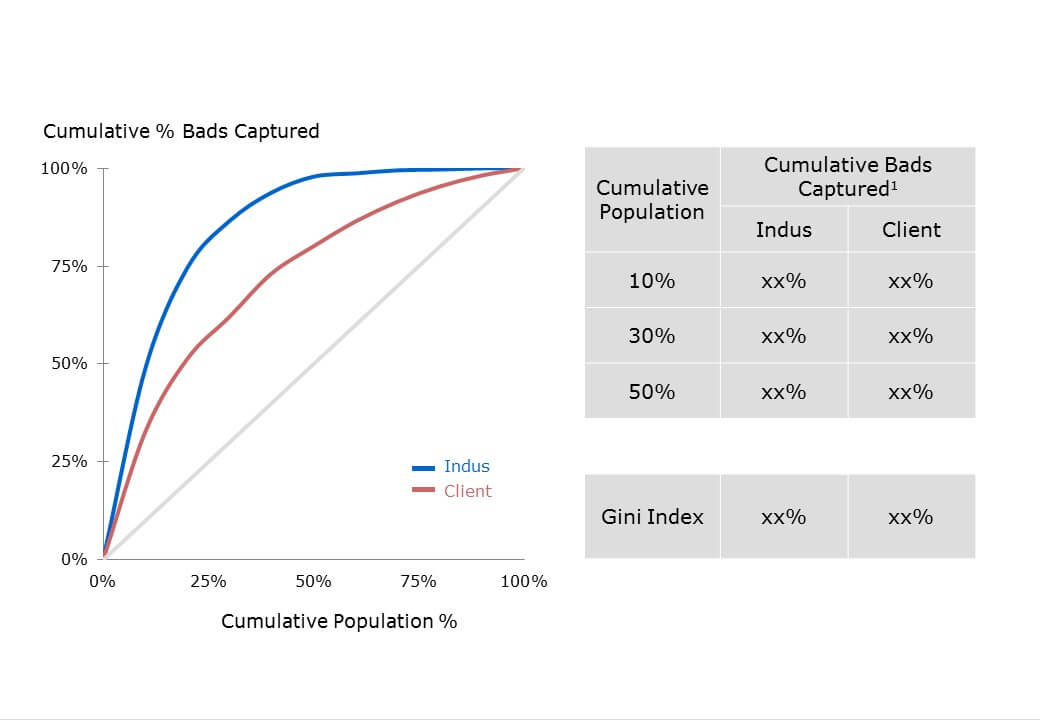

- Tested multiple approaches – CART, CHAID, various regression techniques, and ensembling methods (bagging, boosting, random forests, etc)

- Developed model suite led to 7 point Gini uplift vs. existing model; Bad rate 10% higher in worst deciles

- Indus model has been deployed by the Client