Case Studies

Drove 25% increase in credit card applications through Machine Learning based response models

Financial Services, MarketingWe used machine learning models to drive 25% increase in credit card applications

Approach

- Client was a US credit card issuer, acquiring customers through Direct Mail and Digital channels

- We optimized DM strategy by first developing a “Cold Start” response prediction model (for the initial campaign) and then a refined model later on

- Cold start model used bureau data

- Refined model used own campaign data

- Approach involved:

- Horseracing regression vs. Gradient Boosting (GBM)

- Evaluating sub-models

- Testing ~2k variables

Analysis

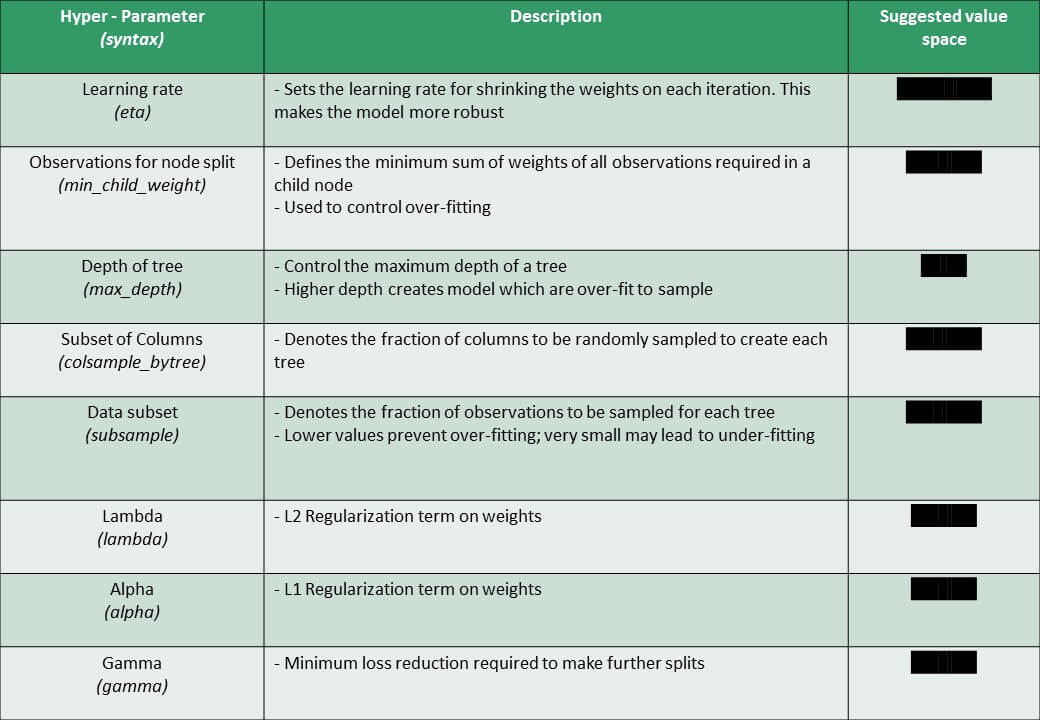

Hypertuning of Parameters (GBM Model)

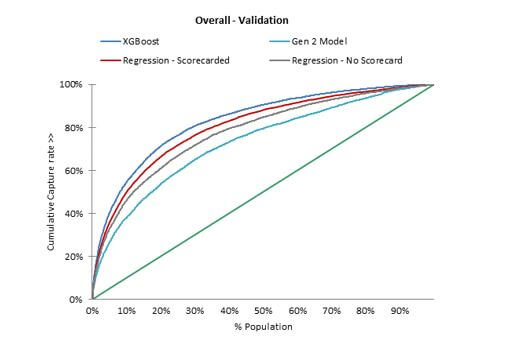

Model Performance of one segment (comparison of Techniques)

Results

- Hypertuning of GBM was performed and compared against CVLR approach

- Bayesian optimization done

- Final 150+ variables used

- Overall model had 80%+ accuracy; GBM model outperformed regression models by 5-10 Gini points

- Final DM campaign led to ~25% more applications for same mktg. budget