Case Studies

Improved card activation by 20-50% for a Top 5 global bank using behavioral analysis and targeted programs

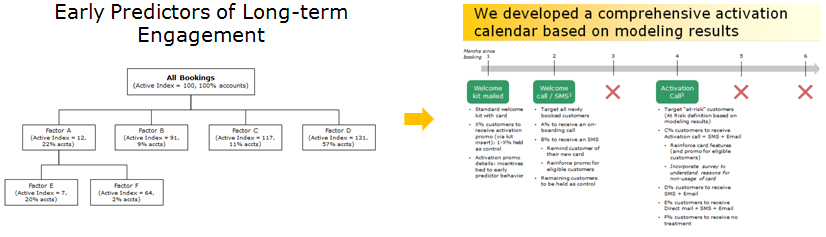

Financial Services, MarketingWe drove an overhaul of card activation strategies for a major credit card issuer, with the goal of increasing first-time activations. This was achieved through a two step workstream – (a) identifying early predictors of long-term activity, and (b) designing, testing, and refining targeted strategies to improve performance on early predictors. The initiative led to a 20% increase in activation rates and as much as 50% increase in other positively-correlated KPIs.

Approach

- Retained by major credit card issuer to drive early activation rates of credit cards

- Adopted a two-step approach: (a) Identify predictors of long-term activity, and (b) Develop, Test, and Refine interventions to positively impact early behavior

- Used decision tree based modeling to identify predictors; Developed statistically designed test to measure impact of interventions

Analysis

Results

- Identified specific early behaviors strongly indicative of long-term usage

- Launched activation intervention strategies based on promotions, channels, and messaging

- Led to 20% increase in early activation rate and 50%+ increase in NetBanking registrations