Case Studies

Customer Segmentation, Valuations, and Credit Policy

Financial Services, Marketing, Risk ManagementWe developed application level credit card LTV model for a leading bank and used LTV model to overhaul decision & line policy and evaluate new products

Approach

- Client was a large global bank w/ ~6 Million card customers

- Indus was tasked with overhauling valuations of the credit card business

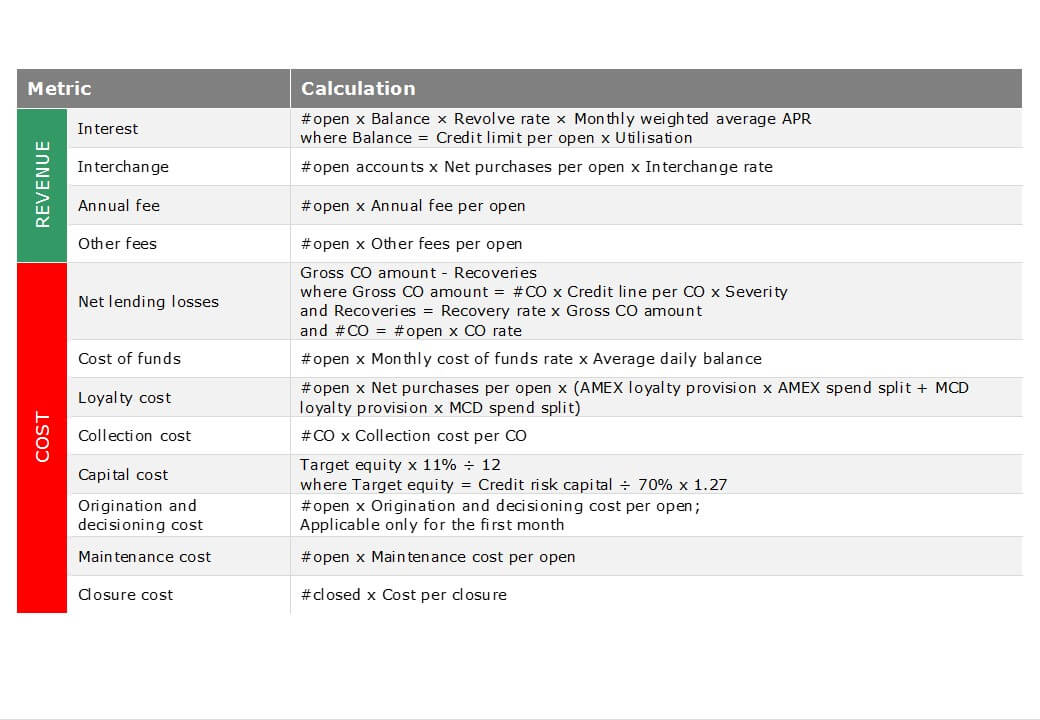

- We developed comprehensive application-level valuation model that predicted revenue & cost drivers at a granular level

- Behavior-based customer segments were identified for each profit driver; Key month-over-month assumptions were developed for each driver

Analysis

Profitability Drivers of LTV Model & Calculations

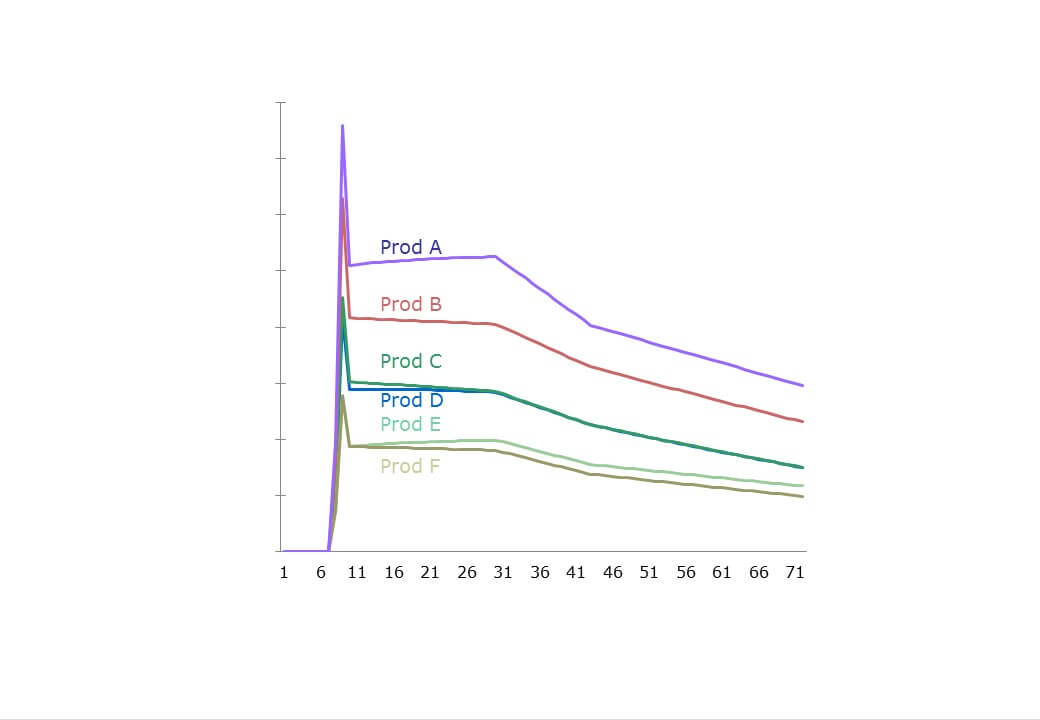

Monthly Loss Rate by Product (#CO/#Open)

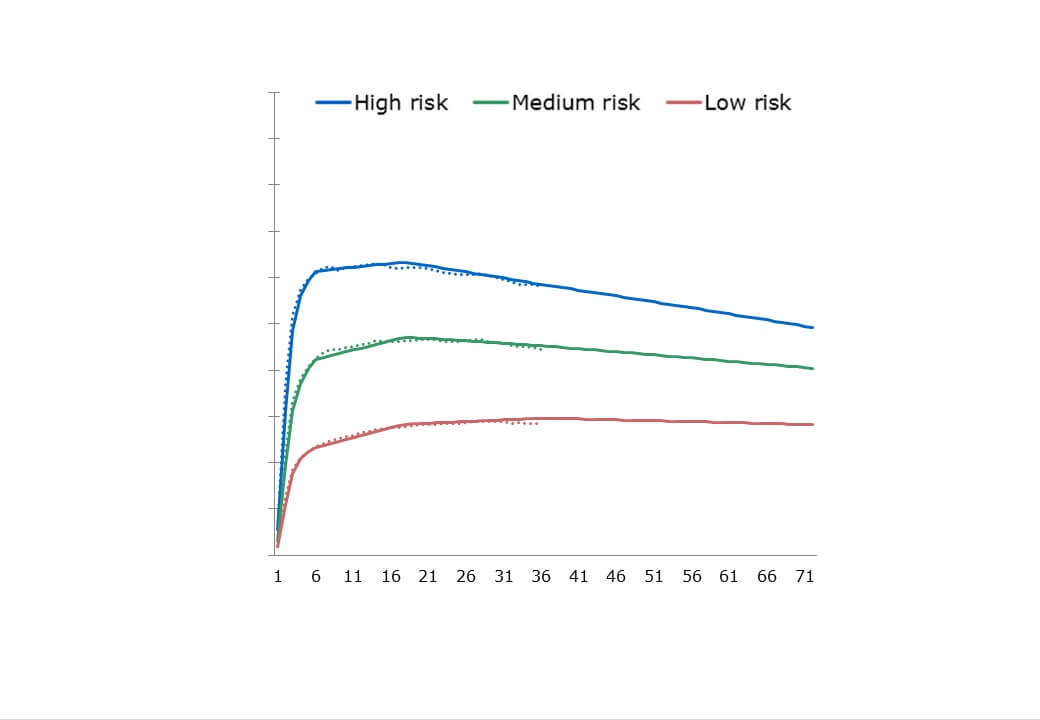

Credit Line Utilization by Risk (Product A)

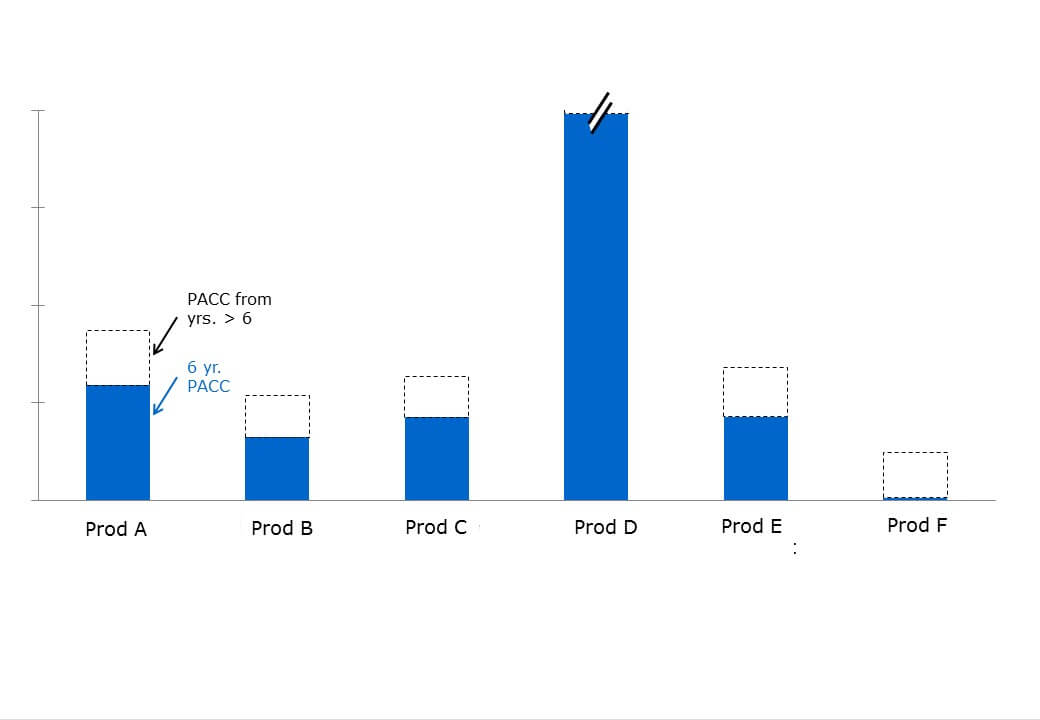

Profitability per Account by Product

Results

- Identified 2 new segmentation dimensions with differentiated usage patternsLaunched outbound phone sales campaign on target population.

- Optimized approve/decline policy to increase profitability by ~10% while reducing exposure

- Currently using the model to optimize initial limit assignment

- Model being used to evaluate new product decisions & perform macroeconomic scenario gaming