P2P Lending and Big Data : Banking on the Non-Banks

Posted by admin updated on 16 Jul, 2015

This is a reproduction of the original article that was published on CrowdFundBeat. The original article can be found here.

Banking on the Non-Banks

Online and Peer-to-peer (P2P) lending, the practice of money lending that circumvents traditional banks, is enjoying explosive growth and popularity with no signs of abatement in the early part of the year. Companies established in the marketplace are facilitating billions of dollars of loans. One of the first industry entrants and the largest player in the market, Lending Club, raised $900 million in last year’s largest technology public offering and is now engaged in a joint venture with Google. With this IPO, Lending Club now has a market capitalization of $7.4B, which is nearly 10 times that of the largest prepaid debit card company Green Dot, and larger than that of one of the largest regional banks, Zion Bank ($5.4B). OnDeck Capital, a similar online lending platform focused on providing financing to small businesses, has disbursed nearly $2B in loans and went through a successful IPO with a valuation of ~$1.3B. Other firms, from start-ups to investors to ancillary technology providers, are rushing to join the party, in recognition of the fact that there is significantly more upside to be gained.

While there has been a lot of excitement and interest in online and P2P lending, it still is a small piece of the total consumer lending pie. The total amount of non-revolving consumer loans in the US was $2,424B as of Dec 2014, per the Federal Reserve. Compare this with the loans disbursed by the online lenders – about $10B to date, not accounting for paydowns. So the online lending space has a share of less than a percent of the total US personal loan market. Having said that, the reason why banking industry needs to look at this sector seriously is the rapid growth rate. Lending Club disbursed $1.4B in loans in Q4 2014, while the same figure for a year earlier was $0.7B – a 100% annual increase. Other issuers are experiencing similar growth.

P2P No More

Alternative lending models like P2P are not exactly new. Lending Club has been in the business of facilitating loans for seven years. In its infancy, P2P lending activity was mainly conducted between private individual borrowers and lenders. This is no longer the case.

Today, P2P and online lending activity is moving quite rapidly from the fringe and further into mainstream, especially for larger financial institutions. Looking no further than January’s news that two financial giants, Societe General and Goldman Sachs, were in discussions to invest in yet another new entrant to the fray.

Most of the focus of online lending to date has been on the retail investor, which is where the P2P moniker originates. But some might say its no longer an appropriate term as nearly 60% of loans, by some accounts, are actually funded by institutional investors who consider this an alternative asset class. These institutional investors have access to tools and analysis to develop platform-beating models, cherry pick the right loans and mitigate risk associated with those loans. This ultimately means that business from good, profitable applicants is in play, as online players compete with traditional banks for borrowers at the upper echelon of the worthiness pyramid, those with good credit profile and a history of positive payment behavior.

Better, Faster, Stronger

So what are the drivers of online lending’s recent expansion and forward momentum? Why it is that a marketplace that has been around for nearly a decade is only now garnering attention not just from borrowers and lenders but from the investment community as well?

For anyone who has ever endured the onerous administrative process of obtaining a loan via traditional methods, the appeal of online lending is quite obvious. For the individual borrower, online lenders offer better rates, an easier experience that can be done online and quick disbursals of capital. Lending Club’s customers reported a 30% drop in interest rates when they switched to the platform from traditional loans and credit cards debt. OnDeck claims that it takes just ten minutes to complete its loan application, a decision is conveyed right away, and funds are disbursed via ACH within 24 hours. Such better rates and faster service leads to the platforms attracting customers with stronger than average credit profiles – “positive selection”, as it is called in lending parlance. This leads to a virtuous cycle of lower losses, better profitability, and hence the ability to offer better rates.

Small businesses, whose capital needs are usually underserved by banks who opt to avoid engaging in the labor-intensive underwriting process when smaller numbers are involved, benefit from the borrowing options offered through these platforms. For lenders on P2P platforms, private individuals can enjoy a much higher return than today’s savings accounts or other low risk investments offer. Institutional lenders can have direct access to the previously difficult to reach consumer finance asset class.

There are two key aspects that allow online lenders to provide better rates: their lower operating costs, and sophisticated underwriting using Big Data & Analytics.

Low Overheads

|

Operating Expense Comparison – Lending Club vs. Traditional Bank |

||

|

(All figures in USD Millions) |

||

|

Lending Club |

Zions Bank |

|

| Net Loan Revenues | $ 211 | $ 1,818 |

| Sales, Marketing and Advertising | $ 87 | $ 23 |

| Total Op Ex | $ 243 | $ 1,714 |

| Op Ex less Sales & Marketing | $ 155 | $ 1,691 |

| (Op Ex – Sales & Mktg.)/Net Loan Revenues |

74% |

93% |

| Note: | |||

| Net Loan Revenues for Zion Bank = Net loan interest income + loan sales & servicing income | |||

| Source for all figures – Annual Reports of respective companies | |||

| Lending Club figures are for FY2014, Zions Bank are for FY2013 | |||

By adopting a completely online route, these lenders are able to forego significant costs that are incurred by a traditional bank. Think of the rent and maintenance costs associated with having bank branches, salaries to be paid to staff, costs incurred in handling paper applications, etc. To illustrate this further, let’s take the example of Lending Club and Zion’s Bank:

Operating Expense Comparison – Lending Club vs. Traditional Bank

(All figures in USD Millions)

Lending Club Zions Bank

Net Loan Revenues $ 211 $ 1,818

Sales, Marketing and Advertising $ 87 $ 23

Total Op Ex $ 243 $ 1,714

Op Ex less Sales & Marketing $ 155 $ 1,691

(Op Ex – Sales & Mktg.)/Net Loan Revenues 74% 93%

Note:

Net Loan Revenues for Zion Bank = Net loan interest income + loan sales & servicing income

Source for all figures – Annual Reports of respective companies

Lending Club figures are for FY2014, Zions Bank are for FY2013

As can be seen above, a traditional bank such as Zion’s Bank ends up spending a larger fraction of its loan revenues on non-marketing overheads (93%) as compared to Lending Club (74%).

Big Data & Analytics

Without question, the emergence of Big Data has been and continues to be a key force in a market that, by some estimates, will continue to double in size in each coming year. The availability of information about prospective borrowers and the ability to aggregate it quickly and overlay algorithms to arrive at actionable results has been a boon for P2P lending growth. Big Data analytics platforms enable institutions to develop predictive models that increase the chances of getting better returns, giving them an edge against banks while allowing them to maintain a less administrative process and provide the quick decisions borrowers come to expect in the online environment.

With access to innovative big data platforms and the expertise to properly analyze it all, institutions active in this alternative investment environment are able to go well beyond the traditional data provided by credit bureaus, creatively unlocking insights available through the digital channel to gain a much better understanding of a prospective borrower’s history and shape a more accurate risk assessment.

Among some of the ways institutions are and can use data analytics to succeed in the P2P lending environment: – Context of Inquiry:

- Lenders can follow the path taken by the applicant before landing at their P2P platform by looking at searches conducted, online behavior and sites visited. A near immediate assessment can be made about that candidate’s risk profile. For example, Prosper is today using data taken from referral sites to inform loan terms, rates and conditions.

- Data Marrying: For both private and business borrowers alike, a trove of non-traditional data is available and accessible from online behavior that can help the lender arrive at a picture of the prospect’s credit worthiness. Yelp profiles, Amazon and EBay ratings, educational and professional history information derived from LinkedIn pages all can help illuminate a borrower’s credit worthiness. Two lenders, CAN Capital and OnDeck, are currently pulling data from these types of sites. When aggregated and married together with data analytics applied over the top, the insights derived can be extraordinarily insightful.

- A/B Testing: Much like e-commerce companies use A/B testing to assess and measure changes to various pages of their websites, online lenders can use real-time data analytics to continuously refine their predictive models and separate the “good” from the “bad.” Lending Club, for example has undergone multiple revisions of its models in the last couple of years.

- New Enhanced Technology Providers: For online lenders, speed is of the essence. As the market has matured bringing larger, more established entrants into the fray, the race to pluck the more attractive opportunities is dependent not just on access to data but speed of analysis. New ancillary platforms, like the recently funded LendingRobot, automate the process by applying algorithms that allow lenders to quickly identify and invest in the most attractive loans. The availability of these services and ability to quickly ingest data help lenders make smart, intelligence-based decisions.

While some of the above ideas are already being used by online lenders, there is a vast amount of innovation still to be done. Smart and innovative data scientists can push the envelope further – improving the ability to identify good credit risks from bad. In our own experience, we have seen compelling value being created through the use of Big Data and alternative credit scoring approaches:

Note:

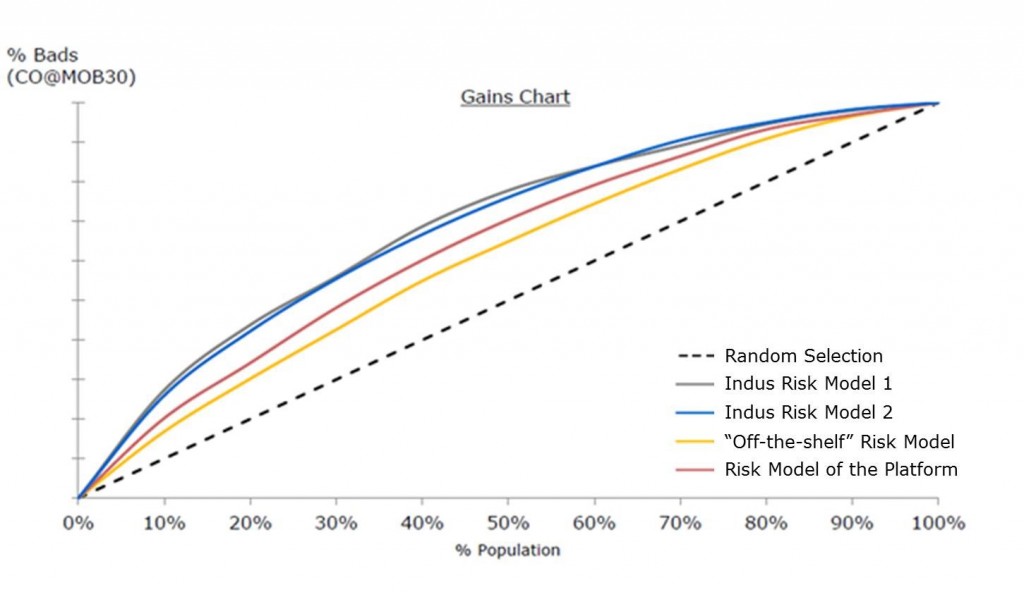

- Gains chart shows the ability of a credit risk model to predict “bad” loans. The steeper the chart initially (i.e. on the left), the better is the risk model

- “Bad” loan is defined as a loan that charged-off by or before month 30

- Above results are for one leading US online lending platform. Similar results observed for other platforms

As can be seen from the chart above, a credit scoring model developed using Big Data approaches and smarter Analytics allows for better capture of “bad” borrowers. Armed with such powerful analytics, online lenders and lenders can better price loans and cherry pick borrowers, leading to higher efficiency in the system and better overall returns.

Takeaways

First, the banking industry needs to take online lenders seriously. It won’t be too long before online players start materially chipping away at the personal loans and credit card portfolios of the industry. The fact that loans and credit cards also happen to be the largest profit drivers in consumer banking makes the risks even larger.

Second, it is clear that the consumer will choose the lender that offers better rates and an easier process. Banking professionals need to evaluate their process for loan applications and underwriting and remove onerous steps.

Finally, risk professionals at financial institutions need to adopt alternative data sources and non-traditional risk scoring approaches in their underwriting. Those content to just use credit bureau data and FICO scores, be in for a shock. Online lenders are marrying alternative data and information collected from digital sources to come up with more accurate risk assessments.